They say there are only two things certain in life…

I’m not anti-tax. I believe we should all pay our fair share. The issue being what’s considered fair. Should the very wealthy get the biggest tax breaks? Should the very poor pay no tax? Should the heaviest burden be placed on the middle class? If you follow politics you will get a good sense of how these questions divide us politically and socially.

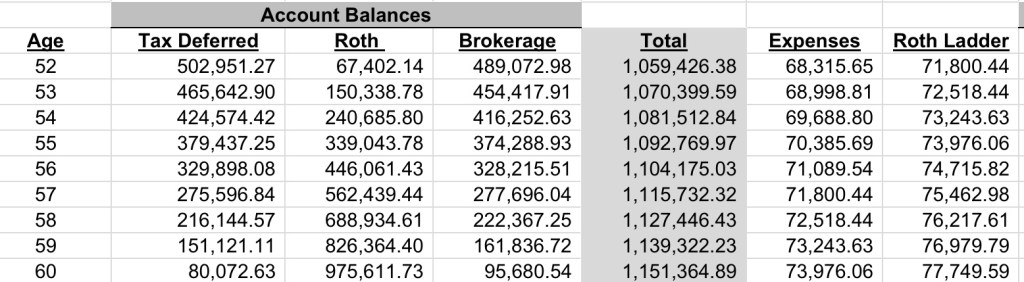

One of the biggest drains on retirement income, besides the unpredictability of medical costs, is taxes. If you can maintain a low cost lifestyle in retirement, you can live off your retirement accounts nearly tax free.

There are three types of investment accounts; taxable accounts, tax deferred accounts and tax exempt accounts.

Taxable Accounts

Taxable accounts include brokerage accounts which are also known as individual taxable accounts. These are funded by after tax dollars and there is no limit on your contributions. Since you have already paid taxes on these dollars, you are not required to pay any additional tax on your distributions. However, you must pay taxes on any gains you made on these dollars known as capital gains. There are two types of capital gains and are taxed differently. Any gains you realize on distributions which are less than twelve months old are considered short-term capital gains and are taxed at a higher rate, as high as 37%. Any gains disbursed after twelve months are considered long-term capital gains and are taxed at your standard income tax rate. You will also be taxed on dividends. Dividends are generally taxed on an annual basis at your standard tax rate for taxable accounts, and would not incur additional taxes at the time of disbursment.

Tax Deferred Accounts

Tax deferred accounts, a type of tax advantaged account, are funded by pre-tax dollars. These include accounts such as your workplace 401k or standard IRA. Since you do not pay taxes on your initial investments, gains or dividends until you start to take disbursment, there is a limit on annual contributions. These limits are currently set at $19,000 or $25,000 for 401k if you are over 50, and $6,000 for IRA’s or $7,000 if over 50. The requirements on when you can begin your disbursments without additional tax penalties is currently set at age 59 1/2, at which time your disbursments would be taxed at your standard tax rate. It’s also important to note, if you are separated from your current employer at age 55, you may also be eligible for penalty free withdrawals from their sponsored 401k. If you roll these dollars over to an IRA, you are not eligible to withdrawal at age 55 without an additional tax penalty.

Tax Exempt Accounts

Tax exempt accounts are also a type of tax advantaged account and are funded with pre-tax dollars. These accounts include your Roth accounts and grow truly tax free. You may withdrawal your contributions at any time, but since you pay no tax on disbursements, including gains after age 59 1/2, there are limits on contributions. Contribution dollar limits are set the same as your standard IRA and your total IRA contributions cannot exceed these limits annually. There is also a limit on who is eligible based on annual household income. Since these limits can change from year to year, I encourage you to check these limits each tax year. A big advantage to the Roth for early retirees, is the ability to rollover funds from your tax deferred accounts to your Roth account penalty free, as long as you wait 5 years to dispurse these dollars. This is known as a Roth Ladder.

Disclaimer: I am not a licensed financial planner or tax expert. Any views expressed are my own and based on what I have learned on my financial journey. Please do your own research before making important financial decisions.