Have you ever noticed that each year the cost of most goods and services increases? I have also noticed, especially with food and other household consumables, that portions seem to go down, packaging gets flimsier, and services are reduced as prices increase. This is the consumer outcome of annual inflation. Company expenses increase and shareholders expect more value from their investment. This drives up the need to corporations to grow their profit margins. In the United States, annual inflation averages around 1.5%. Between 2000-2020 inflation has been as low as -.4% and as high as 3.8% per year.

If you are fortunate enough to work for a company that provides annual pay increases, you may have noticed that these increases generally fall in-line with the respective years’ inflation rate. Some organizations refer to this as a Cost of Living Adjustment or (COLA). Companies that do not offer this benefit may experience more employee turnover, as employees seek opportunities elsewhere, for higher paying jobs to offset inflation.

While earning compound interest will help to rapidly increase your savings and investments, the same holds true for the reverse effect of compound inflation, requiring more money for the same goods and services each year. As you are planning your expense budget during your working years, and through your retirement years, it is important that you factor in for inflation. As a conservative estimate, most planners will factor in a 2% inflation rate. Since we can’t tell the future, this is a safe estimate but probably on the aggressive side. I recommend using between 1-1.5%. Keeping in mind that some of your future expenses may need to be adjusted through reduced spending to offset inflation factors.

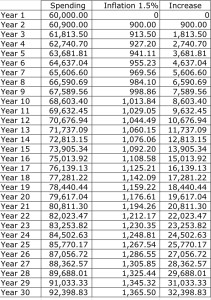

Below I have included a table which shows the effect of inflation on annual expenses over a thirty year period. As you can see, the compounding nature of inflation can produce drastic changes in your annual spending needs over time.

If you start out expecting to spend $60,000 per year in your budget, with inflation compounding over thirty years, you can expect to need $92,398.83 to maintain the same lifestyle based on 1.5% inflation. Most of us will not have the same spending patterns during our retirement years, as our needs will change over time, so keep that in mind when you are planning for your future. Again, this table is merely to show the impact of compounding inflation on spending, and the importance of factoring for inflation.

Disclaimer: I am not a licensed financial planner or tax expert. Any views expressed are my own and based on what I have learned on my financial journey. Please do your own research before making important financial decisions.