Maybe the most powerful tool in the retirement toolbox is the Roth IRA. That said, there are a couple of drawbacks we will discuss first to get them out of the way.

1. There is an income limit for the Roth IRA. The limits can change year to year so I advise you to check these limits before opening your IRA.

2. There is a maximum annual contribution for the Roth IRA. Again, these limits can also change year to year so best to know the rules. If you open an IRA and break the rules, you can face stiff financial penalties.

Now, for the good stuff…

The Roth IRA is funded with after tax dollars. This allows the IRA to grow truly tax free as opposed to a traditional IRA or 401k, which is funded with pre-tax dollars, and are considered tax deferred accounts. When you withdraw funds from the tax deferred accounts, you must pay taxes on your contributions and possibly your gains, especially if you are planning to retire before age 59.5.

During early retirement, chances are you will have the bulk of your monetary assets in your 401k. If you withdraw these funds before age 59.5, you are taxed at your current tax rate, plus an additional 10% penalty. To avoid this penalty, you have a couple of options. If you are 55, and separate from the company sponsoring your 401k, you can begin early withdrawal without penalty. If you are not yet 55, or maybe have multiple 401k accounts from previous employers, you can do what is called a Roth Ladder.

In order to build your ladder, you will first need to have a good understanding of how much you need per year in retirement. I advise you to track your spending for several years before retirement to understand your spending needs. This is also a good way to reduce your spending habits by understanding where your hard earned money is being spent on a monthly and yearly basis.

After you have a good handle on your annual finances using Personal Capital, You can calculate your future needs including inflation and taxes. I have included a link to my favorite spreadsheet here. If you are anything like me, this will give you hours of enjoyment running through “what if” scenarios. This spreadsheet will help you build a plan for your Roth Ladder as well.

The basis of the Roth Ladder is a sort of loop hole in the tax rules. Basically, you can transfer assets from your deferred accounts into your Roth account, before your official retirement age of 59.5, and not have to pay the 10% penalty. The catch is, you can’t touch the funds for 5 years. There is no max limit on how much you can transfer, unlike the contribution limits I explained earlier. During this 5 year period your contributions and transfers will continue to gain value with your investments.

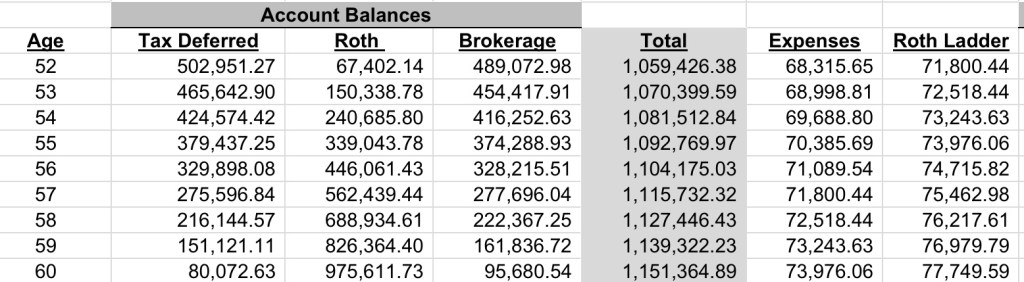

To better explain the Roth Ladder, let’s say Joe retires at age 52 with the following assets:

Joe has calculated his annual expenses in the first year of retirement, and is using an 8% rate of return with a 4% withdrawal rate from his retirement accounts. Using the retirement spreadsheet, adjusting for annual increases and reduced spending to help offset some of the inflation costs, Joe comes up with the following personalized Roth Ladder.

The good news for Joe is that by controlling his spending, and having a little luck with the markets, he will be able to maintain his lifestyle and increase his wealth or increase his annual spending, should he choose to.

The bad news, remember when I said you can’t touch your Roth conversions for at least 5 years? Well, Joe will have to fund at least his first 5 years of retirement before he can tap into his Roth account. Also, you can’t change your mind after you have started the transfer. The best advise is to wait until late in the year to analyze your spending before beginning your annual conversion.

More good news for Joe, he has built up a significant brokerage account which can sustain him for the first 9 years of his retirement. Here is what Joe’s ladder looks like through age 78.

Keep in mind that your conversions are taxed as income at your current tax rate. If you want to start your conversions before you retire, you will need to calculate in this additional income for tax purposes, along with your salary. Obviously this is not a popular choice for most early retirees.

There is also an option to stretch out your conversions over a longer period of time to reduce your taxable income. For this option, it may be best to complete your conversions before age 70 when the mandatory withdrawals kick in for tax deferred accounts. The spreadsheet can assist with this scenario. Feel free to run the options and see what works best for you. Here is what Joe’s ladder looks like by spreading his conversions before age 70:

Disclaimer: I am not a licensed financial planner or tax expert. Any views expressed are my own and based on what I have learned on my financial journey. Please do your own research before making important financial decisions.